In the world of finance the day trading market is popular because it allows traders to gain from price fluctuations that occur in the short term. For those who use Ninjatrader, using the right tools can be a major factor in the success of trading. This article explores Ninjatrader’s day trading signals methods, strategies, systems, and indicators. The article provides a complete review for both experienced and novice traders.

Understanding Ninjatrader Day Trading Indicators

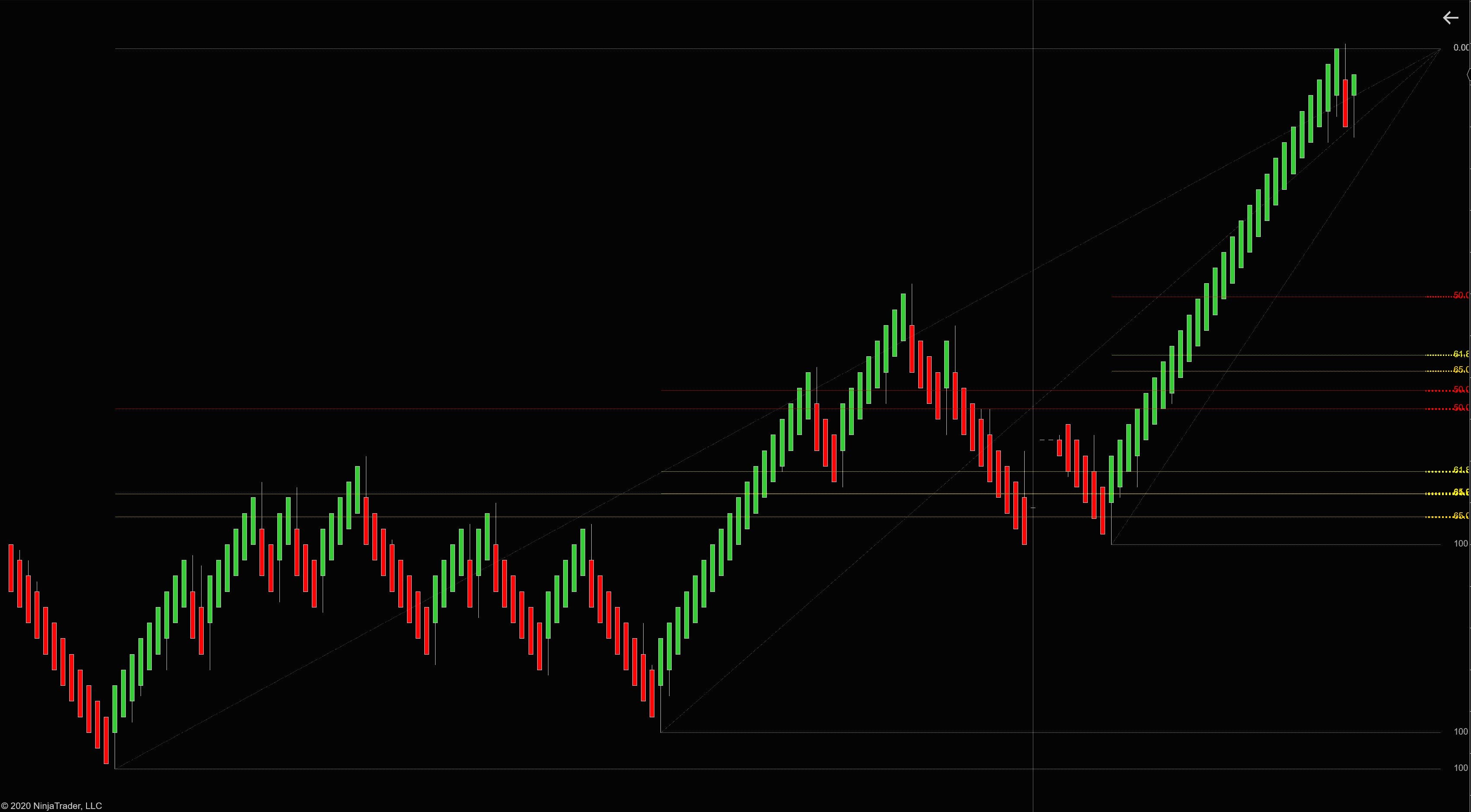

Ninjatrader day trading indicators are important tools that help traders analyze market data to make informed decision. They can be constructed based on a variety of factors like the volume, price, and timing. Moving averages, Bollinger Bands and the relative strength index (RSI) are all popular indicators. These indicators help traders identify trends, determine the volatility of markets and identify potential entry and exit levels.

For traders who are new it’s important to start with the most reliable indicators in order to be sure that there isn’t too much information. Moving averages, for example, are a great starting point because they smooth out price data to show trends over time. When traders are confident, they are able to add additional indicators to the analysis.

The Function of Day Trading Signals from Ninjatrader

Ninjatrader day trading signals are generated using predefined criteria that are set by the trader. The signals alert traders to possible buying or selling opportunities on the market. These signals may be dependent on a single indicator or combination of indicators, providing a greater depth market analysis.

One of the advantages of using Ninjatrader for day trading is its capability to automate the trading signals. The automation will eliminate the influence of emotions and make sure that trades are executed based on objective criteria. Traders are able to backtest their trading signals by using historical data in order to evaluate their effectiveness prior to when they apply them to live trading.

Crafting Effective Ninjatrader Day Trading Strategies

To reap consistent returns the use of a strategy for trading that performs is necessary. Ninjatrader day trading strategies differ from simple to complex dependent on the level of experience of the trader as well as the risk tolerance. One basic strategy would be using moving averages to identify trends, as well as to utilize a stop-loss to control the risk. Advanced strategies can incorporate many indicators and complicated rules for exit and entry, as well as automated trade execution.

When developing a day trading strategy, it’s crucial to think about the market’s conditions and goal of the trader. Strategies should be flexible to the changing the market environment. What works in a market moving may not be efficient in a market that is within a wide range. Reviewing and changing strategies regularly will allow them to remain relevant as time passes.

Building Robust Ninjatrader Day Trading Systems

The Ninjatrader trading system for day trading is a comprehensive strategy that integrates indicators, signals and strategies in a unified framework. These systems can be manual that allows traders to execute trades based on signals or completely automated, where the software handles all aspects of trading.

Automated trading offers several advantages, such as increased efficiency, reduced emotion trading and the ability to rigorously backtest strategies. However, there are some risks inherent to them, such as problems with the system as well as unanticipated events on the market. It is vital that traders regularly check their systems, and to be ready to intervene whenever needed.

Day Trading: Common challenges and solutions

While day trading may be lucrative, it also is not without its difficulties. New traders can face problems because of unrealistic expectations about trading, reliance of random indicators and the emotional process of decision-making. To help new traders succeed it is vital to know the market and be realistic in your expectations.

The success of day trading is dependent on the management of risk. It is essential that traders only invest funds in risk capital that they are able to lose without jeopardizing the security of their finances. Setting stop-loss and size of positions can help control the risk and safeguard investment assets.

Quality Trading Tools are Important

It is crucial that you have access to quality tools to trade for day trading. IndicatorSmart, for instance, provides top Ninjatrader indicators for day trading as well as signals and systems created to give traders the best possible tools. These tools can enhance the analysis of markets, aid in making better decisions and ultimately result in better trading outcomes. Click here for Ninjatrader Day Trading Systems

The final sentence of the article is:

Ninjatrader provides a robust platform for day traders, providing a range of tools and features to enhance the efficiency of trading. Ninjatrader indicators are signals, strategies and indicators that can be used to build an efficient and well-rounded approach to trading. Day trading success requires continual learning, adaptation and the utilization of resources. With the right mindset and tools traders can navigate the challenges and obstacles of day trading in order to reach their financial goals.